This guide to the RLRA Risk Mitigation Program(RMP) is a resource and training tool for property owners & managers and supportive housing service providers working with RLRA.

Overview

RLRA Risk Mitigation Program

What is it?

The RLRA Risk Mitigation program is a financial protection offered to property owners and managers to reimburse costs created by RLRA households. It also functions as a barrier reduction tool for households and eviction prevention tool.

The RLRA RMP is

Financial Protection

Eviction Prevention

Barrier Reduction

Rent/Utility Assistance

FAQ available at bottom of page

Who gets the money?

The funds are a reimbursement to properties for costs incurred or owed by the RLRA household. This removes the balance for the household and enables properties to mitigate costs.

Maximum amount is $5000

up to $25,000 for multi-unit claims

Property receives funds as reimbursement

For all claims under the $5000 limit, a 5% administration cost is added to the claim.

Example

Claim Amount: $1000

5% of $1000 = $50

Reimbursement amount: $1050

When to Use the RLRA RMP

Funds can be accessed during and after tenancy. Almost anytime money is owed to a property by an RLRA household, likely the RMP can be used to pay some or all of the balance.

Most Common Examples

Past due rent or utilities

Unit/common area damages

Appliance damage/replacement

Funded by: Metro SHS Measure

Managed by: Housing Development Center (HDC)

Property Eligibility

A property must be currently renting or have rented to an RLRA household within the past 12 months. Funds are only eligible for costs incurred by the RLRA household and cannot be used to pay any entity other than the property.

If the answers to the following questions are yes, you are likely eligible to file a claim.

Do you rent to an RLRA Household?

Does that household owe money to the property?

Claim Limits

Single Unit Claim

The maximum amount for a single unit, regardless of size, is $5000 per tenancy.

Multi-unit Claim

Claims where more than one unit was affected are eligible for $5000 per unit with a maximum of $25,000.

Two Types of Claims

Operational Loss

An operational loss is any cost that a property incurs during tenancy that does not result in a physical repair/change to the property.

Physical Damage/Repair

Physical damage/repair is any cost incurred by a property that requires a repair or replacement of a physical asset in a unit or common area beyond normal wear and tear.

Step 1

Collect documentation

Step 2

Download and Prepare claim form

The Process

Step 3

Submit Claim Workbook

Step 4

Await Approval/Appeal Letter

Step 5

Receive Funds

Step One

Collect Documentation

Required Documents for All Claims

Tenant Lease

Tenant Ledger

Proof of Rental Assistance at property

Housing Authority Agreement for Rental Assistance (ARA)

Housing Authority New Rent Letter (NRL)

Additional Documents

If a purchase was made or work was completed by a 3rd party receipts and invoices are required.

Operation Losses

An operational loss is any cost that a property incurs during tenancy that does not result in a physical repair/change to the property.

Common Examples of Eligible Expenses

90-days of household rent portion

Unpaid utilities owed to the property

Lease Break Fee

Late Fees

Other Miscellaneous fees (re-key, VCR, etc)

Pest removal

Physical Damages/Repairs

Physical damage/repair is any cost incurred by a property that required a repair or replacement of a physical asset in a unit or common area beyond normal wear and tear.

Common Examples of Eligible Expenses

Appliance repair/replacement

Drywall patching/replacement

Painting due to excessive damage

Fire or water damage

Step Two

Download and Prepare Claim Workbook

Download the Claim Workbook

Visit Housing Development Center’s website for the most up-to-date claim form. Do not use a previously downloaded copy as the form may have been updated.

The claim form is located at the top of the page in red text, “RLRA RMP Claim Workbook”.

Prepare Claim Workbook

“General Info”

The 1st tab is where you will enter the W9 and Lease information. If the tenant has moved out, security deposit information may be required.

Necessary Fields

“Owner Information” & “Person Completing form” = W9 and Contact information

“Property and Unit Information” = Lease Information

“Source Unit Security Deposit & Other Funds Collected”

Only required if tenant has moved out or insurance claim was filed

Receiving Payment: Two Methods

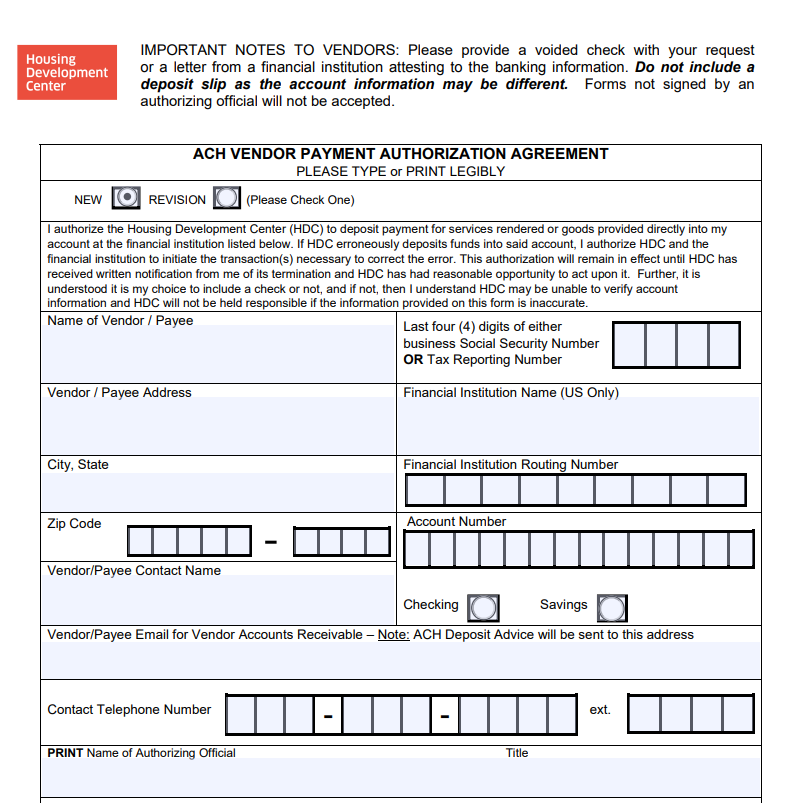

ACH Transfer: Must complete and submit ACH Transfer Form

Check via Mail: Provide Address in Claim Workbook

You do not need to fill in any other tab.

Operational Losses

Document all operational losses in the 3rd sheet tab

“Operational Loss Itemization”.

If Rent is Owed: “Tenant Rent Owed”

Enter the total rent and the portion paid by the household - this can be found on the New Rent Letter or the tenant ledger.

Only 90-days of the household’s portion is eligible for reimbursement

“Rent Loss”

After move-out, if the unit was vacant due to repairs, each day can be claimed as a loss. The daily value is determined by the rent rate of the previous tenancy.

Example

Daily Rent: $50

Day’s Vacant for Repairs: 5 Days

Award Amount: $250

“Other Operating Expenses/loses”

Utilities

Lease Break or Other Fees

ACH Transfer Form Available for Download on HDC’s Website

https://www.hdc-nw.org/rlra-rmp

Physical Damages/Repairs

Document all physical damages/repairs in the 2nd sheet tab, “Physical Damage Itemization”.

Date of Damage/Incident

If the incident was ongoing or hasn’t stopped use the most recent date of event or today’s date

A brief description of what happened to the unit: Give context to the claim

2-4 sentences maximum

Itemization of Costs

- Unit (dropdown will populate with unit information entered in “General Info”)

- Item (e.g. appliance, drywall, paint, etc)

- Vender (who completed the repair or sold the item)

- Invoice # (# on invoice or receipt)

- Amount Applicable to Claim ($ amount for cost of item/repair)

- Description of Deficiency (what caused the need for repair/replacement)

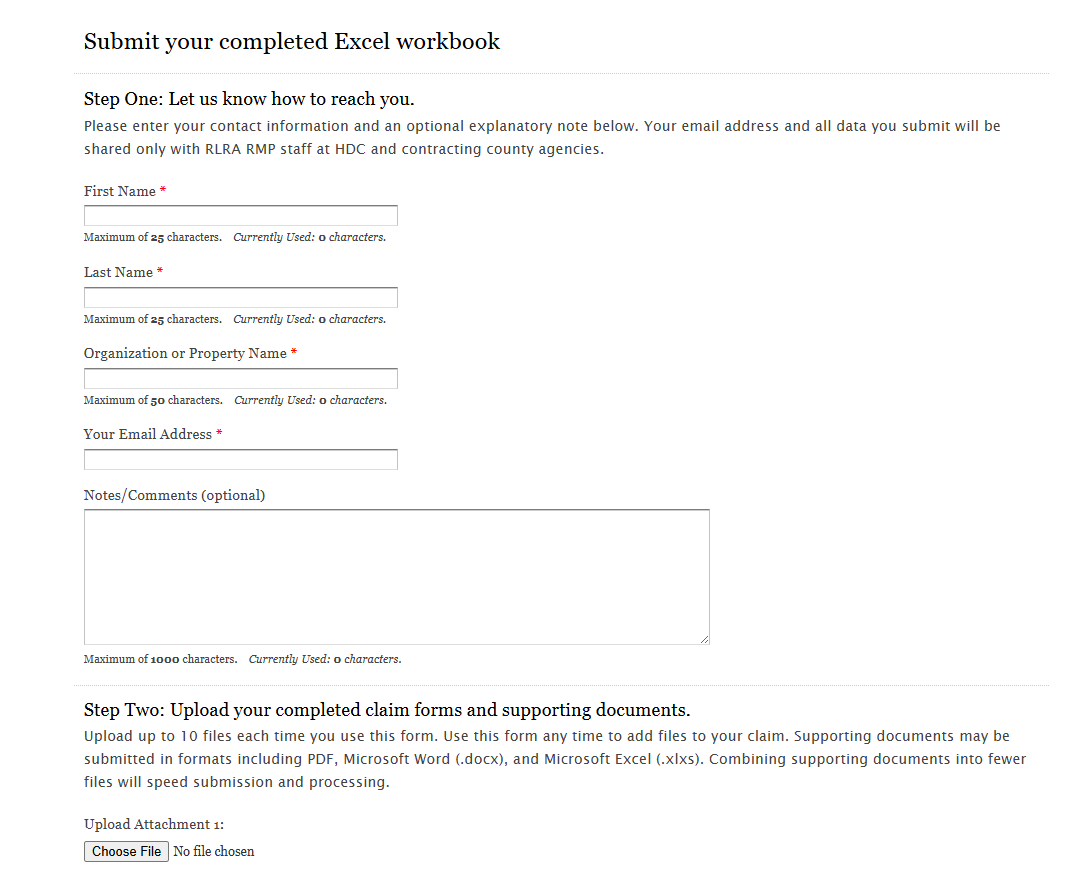

Step Three

Submit the Claim Form

After you have prepared the claim workbook you must submit the completed workbook and all supporting documentation on HDC’s website.

Where to Submit

The submission form is located near the bottom of the page.

Upon submission the email entered into the form will receive confirmation of the submission. If any information is missing, HDC will contact that email.

Uploading Files

You can upload up to 10 files per submission.

Be sure files are named appropriately

Tip: Combine all supporting documents into a Zip File or combined PDF. This can speed up processing of the claim.

Step Four

Await Approval Letter

After HDC has received all necessary documentation they will issue an approval letter detailing the amount that will be reimbursed.

Step Five

Receive Funds

The approved funds will be reimbursed in the method established in the claim workbook, ACH transfer or a mailed check.

Funds can take up to 120 days to be delivered but typically are delivered in 60 days.

FAQ

When will funds for approved claims be delivered to the property?

Funds are delivered within 120 days of claim approval but are typically received by the property within 65 days.

How is the reimbursement sent?

The reimbursement can be delivered via digital ACH transfer or mailed check. This is established in the claim form. HDC must receive a completed ACH Transfer Form to send funds digitally. This can be found on HDC’s website.

Does the $5000 limit reset if a household moves to a new property?

Yes. However if they stay at the same property but change units, the limit does not reset.

Can Risk Mitigation funds be used to pay utility bills?

It depends! If the utilities are owed to the property they are eligible. If they are owed to the utility provider (e.g. PGE, NW Natural) they are not eligible.